This is such and easy column to write! But that’s how it is in news: Too much, too fast, with content deserts in-between.

We will start with GDP because it’s what drives one of our most important of all Economic Indicators: Velocity of Money at M2. Which matters because?

Money has a lot in common with Electricity. As I explained in a Peoplenomics paper back in 2002, or so, both have a “power function.” That’s to say both “make work happen.”

In the case of electricity *(and that Ohm fellow) Volts times Current equals Power (in Watts),. One metric horsepower is about 740 watts *(If you can find a metric horse, usually in Europe. Detroit horsepower was more fictional, in our experience…)

In Economics, the Money Supply at M2 is a fair analog for Voltage. While turnover is our “current” clone. Which is reported (to keep the math-challenged from thinking too deeply) about the Velocity of Money. Which (getting to the point) is cratering.

As you should be able to make out from the above chart (going back to 1950) the “work done by Money” began to fail just as the Internet and wholesale job jacking and offshoring were underway in 1995. We can now see how an Elliott Wave 1 down culminated in Q2:2003.

How to fix? Easy-peasy! Light up some War!

“In 2003, the Iraq War significantly ramped up, beginning with the invasion of Iraq by the US and its allies on March 19th. This invasion, known as Operation Iraqi Freedom, aimed to overthrow the Saddam Hussein regime, dismantle alleged weapons of mass destruction programs, and promote democracy. The war unfolded in two main phases: a brief conventional conflict followed by a prolonged insurgency. “

And this, kiddies, is (more or less) precisely why the “boring economic crap” matters: because if you expect your family name to live on, helps to limit the number of available “front lines.”

Oh, back to the Elliott of M2: At the uber-macro we can see how COVID was a nominal precipitator of Wave 3 bottoming out in 2020. And we’re about rolling over Wave 4. But there really is Good News. The end of the world should be a couple of years out. Though Wave 5 bottoms can be tough.

A Press Release that Matters

Lot of foreplay, sorry. (It’s what us older writers do…) All comes down to a “standard press release” like so:

Real gross domestic product (GDP) decreased at an annual rate of 0.2 percent in the first quarter of 2025 (January, February, and March), according to the second estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 percent. The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending. These movements were partly offset by increases in investment, consumer spending, and exports.

You can always grab the latest Fed numbers from Federal Reserve Board – Money Stock Measures – H.6 – May 27, 2025. Where we see that both the “seasonally spiced” and the “more honest” were up nicely in April. Which we will take to about guarantee the FOMC will NOT BE ABLE TO LOWER at their June 17 meeting.

Meantime, policy wonks keep selling “policy” nonsense to the (monetary-ignorant) GenPop. this works because high schools don’t include the racist math called “coup de fouet” in their teacherings. If they did, that should have triggered you to recall that the phrase directly translates to “crack of the whip” and is used in French to describe the sharp, sudden effect or peak, such as in models describing phenomena like electrical discharge in batteries (e.g., the “coup de fouet” effect in lead-acid battery discharge curves).

This same concept applies in certain economic analyses, where Velocity at M2 can be dismissed as meaningless until you look up and realize “Ure hosed.” Nearly there.

Weekly Unemployment Filings

Why a Rally?

Because America is “comfortably numb?” You tell me: “2022 Monitoring the Future Study: Approximately 24.5% of college students reported using antidepressants, anti-anxiety drugs, or mood stabilizers, indicating higher prevalence in younger populations.” And that’s before we get to seniors with their daily ETOH drips and delta-8s (OK, and 9’s).

Wrong answer? Well…

US Court of International Trade blocks Trump from imposing global tariffs. Two nominal republican appointees and an Obama pick were in the decision which will now head for the Supremes (not the one’s with Diana Ross, the one with Sotomayor, EK, and KBJ). Given Barrett of late, and Roberts having dragged anchor, we call the appeal a 50-50.

This won’t stop DJT from moving policies all over the place, shaking them like a “fart in a hot skillet” but for now, Mr. Science is out: Elon Musk Exits Role in Trump Administration Amidst Corporate and Policy Challenges.

Leaving Trump to focus on core campaign promises: Trump administration to crack down on Chinese visas, applicants, Rubio says. and making up his own crypto brand. But, like we said on the Peoplenomics side this week, the idea of squandering energy to make up “secret numbers” which (in and of themselves do no work except enable drugs and human trafficking) we can’t get too thrilled about that. Say, where are those Epstein files?

A Clausewitz Summer?

The “headline-addict in Chief” will need baby sitting over summer, we fear. Carl von Clausewitz’s primary focus in “On War” is on the nature of warfare; he didn’t explicitly use the phrase “economic war.” However, his core idea of war as a “continuation of politics by other means” can be interpreted to include economic aspects.

We see Trump becoming semi-desperate to get himself a Nobel Peace Prize. (If Obama can, then….)

Which leaves our beloved short-order policy chef cooking economic pressure, trade restrictions, and financial sanctions to pave a road to Stockholm.

Problem: US-Iran Nuclear Talks Stall, Raising Risk Of Escalation And Sanctions. On the stove? Trump Says Iran Strike Would Be ‘Inappropriate’ for Israel Amid Talks | Miami Herald.

Problem: Volodymyr Zelenskyy visits Berlin as he seeks more support for Ukraine in the war against Russia. Over at the stovetop: ‘Disappointed’ Trump sets new timeline for Russia-Ukraine cease-fire progress. BUT, with the seasoning of “no range limits” this week and Taurus missile delivery to Ukraine “within reach” – German Chancellor, it seems “Chef” may have something up his sleave. War this fall to reverse a sliding Velocity problem ahead? RT: If Germany Allows Ukraine To Use Taurus Long-Range Cruise Missiles, Russia Will Strike Berlin – New Istanbul Talks Possible June 2.

All of which (we think) will lead to more of the TACO trade, which if you haven’t been read-in, can be sorted out reading Investors realize that ‘Trump always chickens out’ – Los Angeles Times.

US Dept. of Useless

Bitch and moan all you want but…

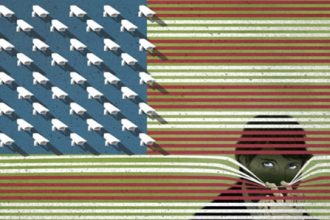

If you think ANYTHING digital is safe: Major data hack nabs 184M passwords for Google, Apple, more.

Don’t you love the idea of headless government? FOLLOW UP: Rogue Shadow Government Takes Shape.

And if you keep track of how :”Equality” ain’t too “equal” in this Orwellian barnyard: South Africa President Resists Trump’s Demand to Arrest Politician Leading Calls to Murder White Farmers.

Around the Ranch: Root Canal Day, Re-Org Plan?

Yep. A punctual and pointed column today in part because I’m going to the root canal chair this morning.

But let me give you the “good news” (such as it was) delivered by my Harvard-trained endowalletist: I didn’t know that pressure was mainly felt in one root while pair from hot and cold was felt in another in multi-root teeth. Who knew?

(More important, who wants to pay $1,500 to learn it unless you have to?) “Moron the morrow” on this – maybe the drugs will be good – no telling.

ReOrg?

Thinking about adding a page (with its own posts) about Old People Wisdom. Been nagging at me because I hit a nerve (doing a lot of that lately, seems, hmm) talking about the screw-job of home insurance when you’re elderly.

There are all kinds of useful little bits of knowledge that we pick up late in life that fall into that “shit I wished I knew when I was younger” (SIWIKWIWY) category. Might set up a submissions thingy for that.

Things like when to self-insure, or how to use tax-loss carryforwards to allow you guilt-free trading on those rare 100:1 odds that come along in markets now and then.

One for the Road?

G2’s house (when we get around to building it) may not have grid power. Price of solar panels is way down right now. I ordered 10-more 325 watt panels (with 80 percent 25-year warranty) for under $70 a panel. 21.54 cents a watt? Hell yeah, let’s replace those last 180 watt panels from 2008 that are putting out under 100W now…

If the Big Beautiful Debt bomb explodes in just a certain way, and with the 30 percent renewable credit alive for the balance of this year? Effective cost of 15-cents a watt for source and new 10 kW class grid-tie (UL-1741) 48 volt systems around $1-kilo buck, it’s almost cheaper to go off-grid than on, out here in the back woods.

Even with shipping (about $275) from SanTanSolar.com it’s adding a few more “chips” to the “Will solar work in Nuclear Winter?” wager…

Write when you get rich,

George@Ure.net

Read the full article here